Another Tipping Point: US Coal Supply Decline So Real Even West Virginia Concurs (REPORT)

Everywhere we turn, environmental news is filled with horrid developments and glimpses of irreversible tipping points.

Just a handful of examples are breathtaking: Scientists have dared to pinpoint the years at which locations around the world may reach runaway heat, and in the northern hemisphere it's well in sight for our children: 2047. Survivors of Superstorm Sandy are packing up as costs of repair and insurance go out of reach, one threat that climate science has long predicted. Or we could simply talk about the plight of bees and the potential impact on food supplies. Surprising no one who explores the Pacific Ocean, sailor Ivan MacFadyen described long a journey dubbed The Ocean is Broken, in which he saw vast expanses of trash and almost no wildlife save for a whale struggling a with giant tumor on its head, evoking the tons of radioactive water coming daily from Fukushima's lamed nuclear power center. Rampaging fishing methods and ocean acidification are now reported as causing the overpopulation of jellyfish that have jammed the intakes of nuclear plants around the world. Yet the shutting down of nuclear plants is a trifling setback compared with the doom that can result in coming days at Fukushima in the delicate job to extract bent and spent fuel rods from a ruined storage tank, a project dubbed "radioactive pick up sticks."

With all these horrors to ponder you wouldn't expect to hear that you should also worry about the United States running out of coal. But you would be wrong, says Leslie Glustrom, founder and research director for Clean Energy Action. Her contention is that we've passed the peak in our nation's legendary supply of coal that powers over one-third of our grid capacity. This grim news is faithfully spelled out in three reports, with the complete story told in Warning: Faulty Reporting of US Coal Reserves (pdf). (Disclosure: I serve on CEA's board and have known the author for years.)

Glustrom's research presents a sea change in how we should understand our energy challenges, or experience grim consequences. It's not only about toxic and heat-trapping emissions anymore; it's also about having enough energy generation to run big cities and regions that now rely on coal. Glustrom worries openly about how commerce will go on in many regions in 2025 if they don't plan their energy futures right.

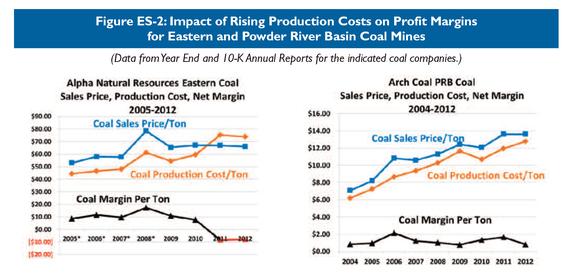

Scrutinizing data for prices on delivered coal nationwide, Glustrom's new report establishes that coal's price has risen nearly 8 percent annually for eight years, roughly doubling, due mostly to thinner, deeper coal seams plus costlier diesel transport expenses. Higher coal prices in a time of "cheap" natural gas and affordable renewables means coal companies are lamed by low or no profits, as they hold debt levels that dwarf their market value and carry very high interest rates.

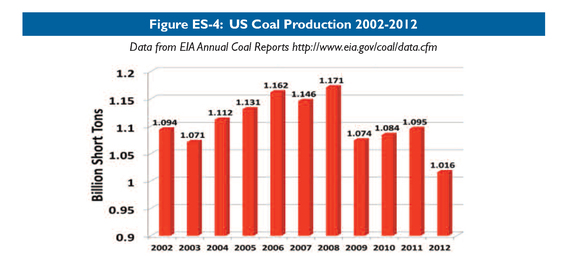

One leading coal company, Patriot, filed for bankruptcy last year; many others are also struggling under bankruptcy watch and not eager to upgrade equipment for the tougher mining ahead. Add to this the bizarre event this fall of a coal lease failing to sell in Wyoming's Powder River Basin, the "Fort Knox" of the nation's coal supply, with some pundits agreeing this portends a tightening of the nation's coal supply, not to mention the array of researchers cited in the report. Indeed, at the mid point of 2013, only 488 millions tons of coal were produced in the U.S.; unless a major catch up happens by year-end, 2013 may be as low in production as 1993.

Coal may exist in large quantities geologically, but economically, it's getting out of reach, as confirmed by US Geological Survey in studies indicating that less than 20 percent of US coal formations are economically recoverable, as explored in the CEA report. To Glustrom, that number plus others translate to 10 to 20 years more of burning coal in the US. It takes capital, accessible coal with good heat content and favorable market conditions to assure that mining companies will stay in business. She has observed a classic disconnect between camps of professionals in which geologists tend to assume money is "infinite" and financial analysts tend to assume that available coal is "infinite." Both biases are faulty and together they court disaster, and "it is only by combining thoughtful estimates of available coal and available money that our country can come to a realistic estimate of the amount of US coal that can be mined at a profit." This brings us back to her main and rather simple point: "If the companies cannot make a profit by mining coal they won't be mining for long."

No one is more emphatic than Glustrom herself that she cannot predict the future, but she presents trend lines that are robust and confirmed assertively by the editorial board at West Virginia Gazette:

Although Clean Energy Action is a "green" nonprofit opposed to fossil fuels, this study contains many hard economic facts. As we've said before, West Virginia's leaders should lower their protests about pollution controls, and instead launch intelligent planning for the profound shift that is occurring in the Mountain State's economy.

The report "Warning, Faulty Reporting of US Coal Reserves" and its companion reports belong in the hands of energy and climate policy makers, investors, bankers, and rate payer watchdog groups, so that states can plan for, rather than react to, a future with sea change risk factors.

It bears mentioning that even China is enacting a "peak coal" mentality, with Shanghai declaring that it will completely ban coal burning in 2017 with intent to close down hundreds of coal burning boilers and industrial furnaces, or shifting them to clean energy by 2015. And Citi Research, in "The Unimaginable: Peak Coal in China," took a look at all forms of energy production in China and figured that demand for coal will flatten or peak by 2020 and those "coal exporting countries that have been counting on strong future coal demand could be most at risk." Include US coal producers in that group of exporters.

Our world is undergoing many sorts of change and upheaval. We in the industrialized world have spent about a century dismissing ocean trash, overfishing, pesticides, nuclear hazard, and oil and coal burning with a shrug of, "Hey it's fine, nature can manage it." Now we're surrounded by impacts of industrial-grade consumption, including depletion of critical resources and tipping points of many kinds. It is not enough to think of only ourselves and plan for strictly our own survival or convenience. The threat to animals everywhere, indeed to whole systems of the living, is the grief-filled backdrop of our times. It's "all hands on deck" at this point of human voyaging, and in our nation's capital, we certainly don't have that. Towns, states and regions need to plan fiercely and follow through. And a fine example is Boulder Colorado's recent victory to keep on track for clean energy by separating from its electric utility that makes 59 percent of its power from coal.

Clean Energy Action is disseminating "Warning: Faulty Reporting of US Coal Reserves" for free to all manner of relevant professionals who should be concerned about long range trends which now include the supply risks of coal, and is supporting that outreach through a fundraising campaign.

Plug-in Hybrids, The Cars That Will Recharge America

Plug-in Hybrids, The Cars That Will Recharge America Oil On The Brain

Oil On The Brain